mstr stock: Down 40% – Should You Freak Out?

Alright, let's get one thing straight: Michael Saylor's MicroStrategy and its love affair with Bitcoin? It's either the smartest play in the history of corporate finance or a one-way ticket to Palookaville. No in-between.

The Numbers Game: Smoke and Mirrors?

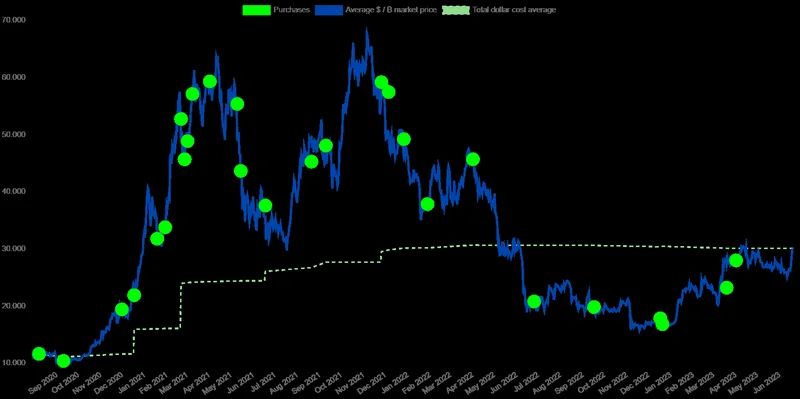

MicroStrategy's stock, MSTR, has been on a wild ride. Up 30x between January 2023 and October 2025, mirroring Bitcoin's own surge. But now? Down 40% in the Past 6 Months, Should You Buy, Sell, or Hold MicroStrategy Stock in November 2025? - Barchart.com. Hitting seven-month lows when Bitcoin sneezes. I mean, come on. Is this a tech company or a leveraged Bitcoin ETF in disguise?

They're bragging about a $2.8 billion net income in Q3 2025, all thanks to "unrealized gains" on their crypto stockpile. Unrealized. As in, it only exists on paper until they actually sell. It's like counting chickens before they hatch, then using those imaginary chickens to collateralize a loan. What could possibly go wrong?

And let's talk about this "no more common shares below 2.5 times net asset value" promise. Except, of course, when they need to cover the $689 million annual interest and dividend payments. So, it's a rule... until it's not. Got it.

They added 487 Bitcoin using $50 million from preferred stock sales. Preferred stock, mind you. Which means shareholder dilution. Which means existing shareholders get a smaller piece of the pie. But hey, at least Saylor gets more Bitcoin, right?

Speaking of which, is anyone else worried about the preferred stock dividend jumping to 10.5% in November 2025? That's not exactly chump change.

Betting the Farm on Funny Money

I've got to ask: Are we really just going to ignore the fact that investor enthusiasm has cooled? I mean, yeah, 12 out of 15 analysts still say "Strong Buy." But analysts also said Enron was a great investment, so... maybe we should take that with a grain of salt. It's a bit like asking a bunch of toddlers if they want candy. Ofcourse they do. Doesn't mean it's good for them.

The premium investors once paid for MSTR shares over its Bitcoin holdings has shrunk. It's hovering near its 20-month low. The market multiple to net asset value has narrowed from 2.7x last year to a measly 1.06x. Translation: people are starting to realize that MSTR is basically just a Bitcoin proxy, and they're not willing to pay a premium for it anymore.

And this whole "exploring international markets" and "euro-denominated preferred shares" thing? Sounds like they're desperately trying to find new suckers... I mean, investors to keep the whole thing afloat. They expect $715 million from this euro share offering. Good luck with that.

The average MSTR stock price target is $523, which is an upside potential of over 120%. But that's based on the assumption that Bitcoin is going to keep going up. What if it doesn't? What if it crashes? Then what?

Oh, and Bitcoin itself is down 20% from its record levels. Just saying.

The Saylor Moonshot: Is He Nuts?

Look, I get it. Bitcoin went up more than 7x between January 2023 and October 2025. MSTR stock went up 30x. But past performance is not indicative of future results, as the saying goes. And relying on a volatile asset like Bitcoin to fuel your entire business strategy? That's not vision; that's gambling.

Investors are questioning Saylor's strategy of continuously buying more Bitcoin, and they're right to do so. This isn't some diversified portfolio; it's a full-on, all-in bet on a single, highly speculative asset. It's like a gambler who keeps doubling down after every loss, convinced that the next hand will be the one that makes him rich.

Maybe Saylor's a genius. Maybe he's right, and Bitcoin is going to the moon. But maybe, just maybe, he's leading MicroStrategy and its shareholders off a cliff. Then again, maybe I'm just being cynical. Nah.