VIX Spike: Economic Data Disruption?

Market's "Extreme Fear" Is Just Noise: Here's What the Data Really Says

The Fear Factor: A Volatility Spike and Data Drought

The market's been twitchy, no doubt. Both the S&P 500 ETF (SPY) and the Nasdaq 100 ETF (QQQ) took a hit, each dropping over 1.5% on Thursday. The culprit? A fading post-shutdown buzz combined with a serious lack of federal economic data. It's got everyone from retail investors to seasoned pros glancing nervously at their portfolios.

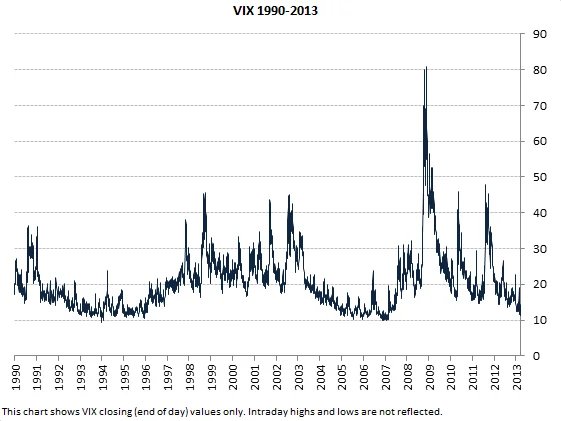

The Volatility Index (VIX) spiked 15%. The VIX, for those unfamiliar, is Wall Street's "fear gauge," measuring expected market swings over the next 30 days based on S&P 500 (SPX) options prices. CNN's Fear and Greed Index—which factors in things like volatility, NYSE breadth, and the put/call ratio—plunged into "extreme fear" territory. (I always take those "Fear and Greed" indices with a grain of salt; they're as much a reflection of media sentiment as actual market conditions.)

But here's where it gets interesting. We're missing key economic reports. The Labor Department is scrambling to release September's jobs report next week, but October's unemployment rate is MIA. October’s Consumer Price Index (CPI) and jobless claims? Delayed indefinitely. White House Press Secretary Karoline Leavitt even suggested the Democrats "may have permanently damaged the federal statistical system.” Strong words, to be sure.

Is this a genuine crisis of confidence, or just a temporary blip amplified by data scarcity? The market hates uncertainty, and right now, uncertainty is the only thing we have in abundance.

Rate Cut Reality Check: A Shifting Landscape

Beyond the data drought, there's the ever-present specter of interest rates. Several Fed officials have voiced concerns about inflation remaining stubbornly above the 2% target. Inflation last clocked in at 3% (to be precise, 2.96% rounded up). Higher rates, the theory goes, curb inflation by making borrowing more expensive.

Nick Timiraos, the Wall Street Journal's chief economics correspondent, noted that “four Fed presidents with a vote...are not actively agitating for a December rate cut (to put it mildly).” That's a notable shift in tone.

The CME's FedWatch tool shows the odds of a 25 bps rate cut at the December FOMC meeting have shrunk to a coin flip: 51.9%, down from 62.9% yesterday and 69.6% a week ago. (These probabilities are derived from futures contracts, so they reflect market expectations, not necessarily the Fed's intentions.)

But here's the rub: the Fed is also tasked with supporting maximum employment. Lower rates are generally good for job growth. Last week, Challenger, Gray & Christmas reported 153,074 job cuts in October – the highest since 2003. It's a classic "damned if you do, damned if you don't" scenario for the central bank.

And this is the part of the report that I find genuinely puzzling. How can the Fed simultaneously fight inflation and support a weakening labor market? It's like trying to steer a car in two directions at once. Are they prioritizing inflation over employment, or vice versa? The data doesn't give us a clear answer, and that's precisely what's fueling the market's anxiety.

So, What's the Real Story?

The market's freaking out, but it's a controlled freakout. The "extreme fear" is driven by a lack of information and the Fed's tightrope walk. The VIX spike is real, but it's also a lagging indicator. As reported by TipRanks, the Stock Market News Review: SPY, QQQ Slump on Economic Data Disruption as VIX Surges 15%, the SPY and QQQ slumped as the VIX surged 15%. By the time fear hits "extreme" levels, the smart money has already made its moves. The key is to look beyond the headlines and focus on the underlying data—or, in this case, the lack thereof. And when the data finally arrives, don't just accept it at face value. Question the methodology, scrutinize the assumptions, and draw your own conclusions. That's what separates the savvy investor from the herd.